Introduction

Well, here we are, another election year, and once again one of the main issues on the table is the economy and inflation. I say “once again,” as seemingly every election year economics is an issue. I’m 73 years old now, and I well recall the first presidential election I took a personal interest in—1960—when JFK was running against Richard Nixon. (I was 9 years old) That year the Cold War against the Soviet Union was the big issue, but the economy wasn’t far behind, and it’s been that way ever since, with economics frequently moving to the front burner, as it is now. Actually, it’s been that way since the Great Depression nearly 100 years ago, and even earlier. Based on this, it seems there is something about economics and money that is not well understood. With our lives being about 9/10ths economic in terms of time and effort spent, it’s the purpose of this paper to do what I can to remedy the situation.

Admittedly, I am not an economist, and my formal education in the subject does not go beyond my Econ 101 class at the University of Washington in 1970. In that class my professor was an avowed socialist, who taught us socialism as if it IS economics, which it isn’t, so it appears even some professors of economics don’t know their subject, which may explain why our elected officials have such a hard time with it. But this brings me to the first major point I wish to make, and it’s a very simple one: economics and politics are different subjects. As such, they are governed by different laws, and it’s a big mistake to collapse the two, which politicians are always trying to do. Unfortunately for them, and for us as citizens, they violate economic laws at their and our peril, as we are currently witnessing with the inflation and rising costs we are experiencing.

Since I am not a formally trained economist, you may be asking yourself what is it that qualifies me to comment on the subject. It’s a legitimate question, so I’ll answer it. For me the story begins 45 years ago, when, because of several projects I was assigned at work, I had the opportunity to study some of the true basics of economics. My initial effort was to try and understand what inflation is and what causes it, which necessitated a deep dive into the subject of money itself and what it is. That study yielded results, and most of what I am sharing with you in this paper I learned at that time. The information I am going to cover in this writing may seem simple to you, but that’s because the basics of a subject usually ARE simple; and because economics as a subject has been made to seem unnecessarily complex, a practice I do not wish to continue. So, with all of that understood, let’s dive in.

___________________

The Simple Basics of Economics

We’re going to start with the simple basics, beginning with the definition of the word “economics” itself. If you look it up on the internet you’ll find a bunch of complex explanations, but, as I’ve already stated, we’re going to keep it simple. Economics can easily be understood as, “the social science that studies the production, distribution, and consumption of commodities.” [1] The word derives from the ancient Greek word “oikonomia,” meaning simply, the “way (nomos) to run a household (oikos).” That’s an interesting derivation. Central to the subject of economics is another key word, “exchange,” which means, “the act of giving one thing and receiving another (especially of the same type or value) in return.”[2] That word derives from the Latin words “ex-“ meaning “out” and “cambiare,” meaning “change” or “substitute.” As you can see, the basic concepts of these words are easily grasped. Now, if you think about it you will realize that for a person be willing to exchange something he produces to another for what he produces, there are two conditions that must prevail:

1. A person must think that he needs more than he, himself, can produce, and

2. The person must be somehow restrained from consuming all of his own production. [3]

To illustrate, in a simple barter economy a farmer works hard all year to grow some corn and harvest it. He now has some corn. He produced it and he owns it. Winter is coming, and our farmer decides he needs some warmer clothes. Joe down the path weaves cloth and sews clothes. The farmer does not weave cloth or sew clothes, and Joe does not grow corn, but considers that he needs corn to eat. The farmer wants Joe’s cloth and clothes and Joe wants the farmer’s corn. To each of them the other person’s product is valuable, and they consider they need the other person’s product to survive. In addition, both realize they cannot consume ALL they produce, as they must have something to trade to each other to acquire the needed corn and clothes. And so we have the basic concepts of “economics” and “exchange,” easily understandable by anybody. You may think that the example of barter exchange described here is something from ancient history, but the truth is that we are just several centuries removed, as such transactions were commonplace in colonial days. Indeed, during times of financial panic and depressions, barter exchange is the economic system of last resort. In colonial times, to make things easier for the community, a system called “warehouse banking” was implemented, which is a step up from barter. The members of the community would submit their exchangeable production to the warehouse, whether crops or cloth or hard goods, and receive receipts certifying their produce was on deposit in the warehouse. If the members of the community trusted these receipts, and believed they could redeem them for the represented produce, this was a helpful system for the times. The individual community member could now simply trade these receipts to other members of the community for the receipts of the kind of produce they needed, and then make one trip to the warehouse to pick up the produce.

A similar example occurred in 17th century London with goldsmiths, who began the practice of storing gold for people in the community, for which they issued receipts to those using the service. As with the warehouse, people no longer needed to haul their gold around to make transactions, instead using the simple expedient of exchanging receipts. In both examples, the warehouse and the goldsmith, we see another key element entering the historical economic equation—paper money. Some enterprising goldsmith, however, took the matter to a different level when he observed that people were using the receipts as currency without bothering to do the intermediate step of redeeming the receipts for gold. Seeing that the receipts were being trusted, he took the step of introducing more receipts into circulation with no gold to back them up. He felt safe in doing this as the receipts were trusted. Of course, things would very rapidly “come a cropper” for our goldsmith if the secret got out that he was issuing more receipts than he had gold on deposit, which I’m sure happened to more than one goldsmith.

Money and Its Functions

Comprehending the above brings us to an understanding of our next key term in economics, and that is the word “money.” The word derives from the Latin word “moneta,” meaning “coin.” In looking at these early examples of the warehouse, the goldsmith and the use of receipts, we are witnessing the evolution of modern banking, as well as the advent of the modern banking definition of “money.” That definition can be stated simply as, “a negotiable receipt for deposited goods.” [4] In this context, the word “negotiable” means, “able to be transferred or assigned to the legal ownership of another person,” [5]which is exactly what happened when people in these early examples of the warehouse and goldsmith exchanged their receipts. Please note that the definition I just gave you is the banking definition of money, but there are other useful definitions as well. One of them, “an idea backed by confidence,” [6] is a useful definition because it communicates the idea that whatever serves as money, whether the paper receipts or a commodity such as gold or silver, must be trusted by those using them. They must have confidence that those receipts or commodities will be accepted by others in return for needed goods and services. This is true of anything that serves as money, including the modern federal reserve note. Whatever functions as money, confidence is the essential ingredient. Without it, that thing cannot function as money.

With that understood, it’s important to also know the functions of money, of which there are primarily three:

The first, the obvious one, is that money provides a medium of exchange.

The second function of money is that it serves as a repository of value, meaning simply that the $10, the $20, the $50 you earn today, should retain the same exchange value a week, a month, or a year from now as it has today.

And the third primary function of money is that it provides a measure of value, meaning simply that a car selling at $10,000 does not have the value of a car that sells for $20,000.

Money, to be money, must perform these functions. As a medium of exchange money allows us to perform transactions without the inconvenience of barter; hauling our produce around to trade for someone else’s produce. As a repository of value, money allows a person to save against future contingencies, retirement, the kids’ education or whatever, secure in the fact that its value when withdrawn and used will be commensurate to its value at the time of earning. As a measure of value, as long as it’s performing its “repository of value” function, money provides a reliable gauge of the value of one product relative to other products. There are possibly other functions of money, but these are the main ones, and when money ceases to perform these functions the confidence in it disappears, and what had been functioning as money no longer does. History is replete with examples of this.

What is Inflation

Understanding all the above, we’ll now move on and tackle the subject of “inflation.” Most people view inflation as a condition in which goods and services are becoming more expensive and their money doesn’t purchase as much. These things are not “inflation,” they are the consequences of “inflation.” “Inflation” is defined as follows:

“An increase in the supply of currency or credit relative to the availability of goods and services, resulting in higher prices and a decrease in the purchasing power of money.” [7]

It’s important to understand this definition. Much has been said about the recent inflation in the United States and the resultant higher prices for groceries, fuel and housing. Indeed, with the pandemic shutdowns and the resultant drop of production (goods and services), compounded by the government’s stimulus handlings of disbursing free money, that we would experience extreme inflation in our country was entirely predictable. The Trump campaign has been making hay with this, attacking Biden and Kamala Harris for their role in causing this situation. The truth is, Trump was president when the shutdowns were implemented in 2020, and thus has his own culpability for the situation. Remember, the definition of inflation is, “An increase in the supply of currency or credit relative to the availability of goods and services…” So, an inflation can be generated in two ways, drastically reduce the production of goods and services relative to the money in circulation, or drastically raise the money in circulation relative to the production of goods and services. The pandemic handlings of shutting down the economy and passing out free money did both. In retrospect, both actions were terrible mistakes and both the Republicans and Democrats are culpable.

In a larger, longer view, however, there is nothing new about inflation as a condition of the U.S. economy. For over one hundred years it has been wreaking its insidious effect on our money, our population and our quality of life. The way inflation does this is by assaulting the functions of money described above. The more that inflation prevails, the less the money can perform its “repository of value” function, as the currency, the dollar in our case, is worth less and less. During extreme inflations, such as that experienced recently in Argentina and that experienced 100 years ago in Germany, the currency value decreases so rapidly that the money earned this week is worth dramatically less by the next week. When this happens the confidence in the money disappears completely and it ceases to function as a medium of exchange. Ahead of those circumstances, as inflation increases in an economic system, the value functions of money gradually erode, to the point where the currency is worthless and the economy reverts to barter. The U.S. dollar is well on this route as I write this, and has been for some time.

When Did Inflation Start?

The irony of U.S. politics, the Republicans and Democrats, is that both parties consistently decry inflation and blame it on the practices of the other party, but they never ask the key question, “When did inflation start?” In various of my writings I have repeatedly emphasized the importance of this question, IF one wants to discover the cause of a specific condition, whether good or bad. When did it start? Whatever the cause, it will be found to have happened or been implemented immediately before the condition being investigated began to manifest. This is one of those “Duh” kind of things, and is so obvious that it makes one wonder if the Democrats and Republicans really WANT to solve the problem. Be that as it may, within a few minutes of internet search one can compile enough information to see rather accurately that inflation culminating in our situation today began to affect the value of the dollar a little over 100 years ago, in the early 20th century. To illustrate the point, I’ll share a couple of graphs:

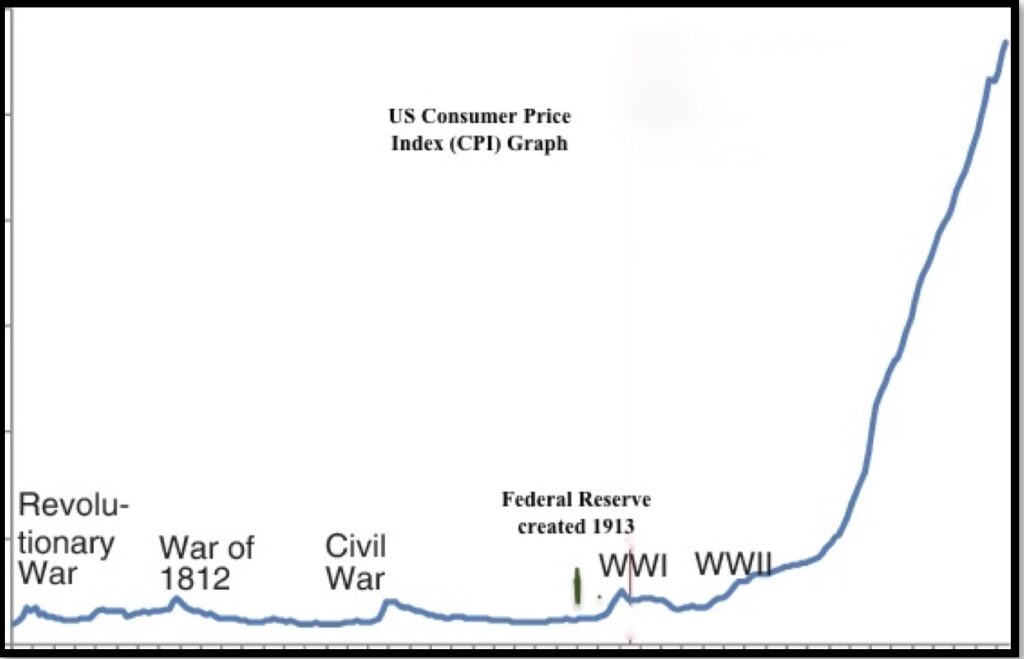

The above graph reflects the US Consumer Price Index (CPI) from the time of the Revolutionary War to present time. If you are not familiar with the CPI, here is the definition according to the U.S. Bureau of Labor and Statistics: “The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by consumers for a representative basket of consumer goods and services. The CPI measures inflation as experienced by consumers in their day-to-day living expenses.” From this graph you can see that the CPI is relatively stable across the first 140 years of our nation’s existence. Then, right before World War I, you can see that the CPI starts to climb, and by World War II is moving into a near vertical rise which continues right up to present time. What this graph actually shows is the relative loss of the purchasing power of the dollar because of inflation, thus eroding the 2nd function of money discussed earlier. Our current dollar against the 1910 dollar has lost over 90% of its purchasing power.

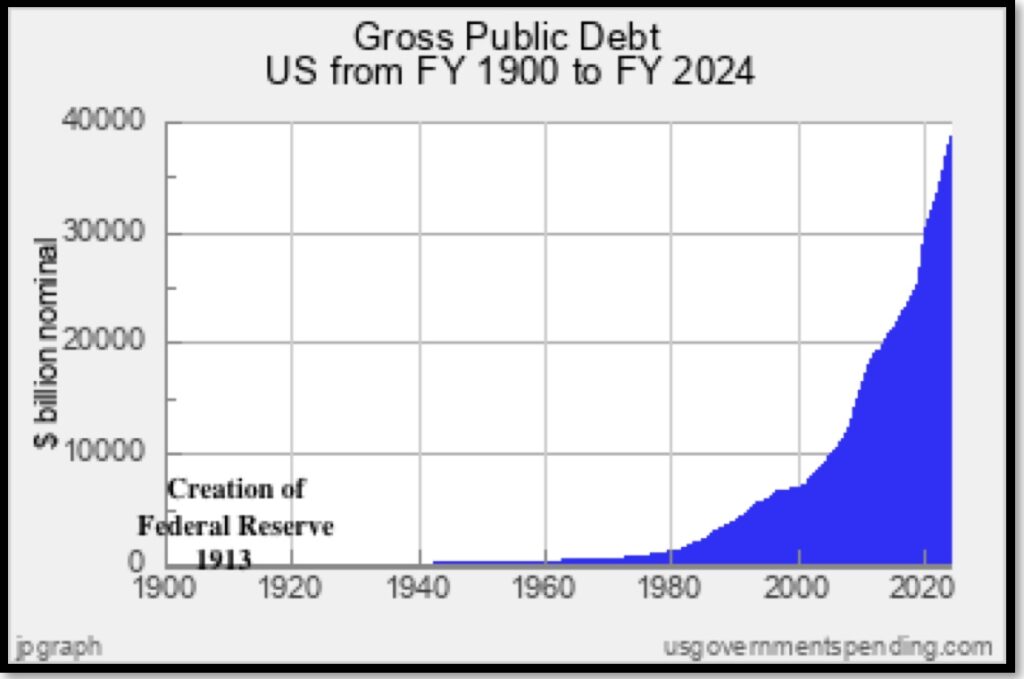

The second graph I’m going to share with you is the graph of our national debt, which recently exceeded the astounding sum of $35 trillion. Here is that graph:

Now, you don’t need to be a statistician to see that the graph of our national debt and the CPI graph parallel each other. And you don’t need to be a genius to see that the debt graph and the CPI graph both start their exponential rise at the same point in time—the early 1900s.

Based on these graphs we can draw some conclusions. First, there seems to be a correlation between the accumulation of national debt and the inflationary loss of the purchasing power of the dollar, as evidenced by the CPI graph. Second, whatever started these graph trends happened in the early years of the twentieth century. Third, both graphs seem to be following the formula of an exponential curve, which, if you recall your junior high school math Cartesian coordinates,[8] is “Y equals X to the Nth power. I recall being astounded when I first encountered this information back in the early 1980s. Back then the national debt was just over $800 billion, and I thought THAT was extreme. If, back in 1980, one sat down and applied that exponential curve formula to that $800 billion debt to predict the future national debt 45 years later, you’d end up somewhere close to our current $35 trillion. In other words, if the elements of the equation remain the same, it is predictable that our debt will continue to expand, and that inflation will ultimately destroy our money and economy. And it will happen regardless of which political party is in power, unless somewhere along the line someone(s) muster the gumption to handle the actual source of the problem.

The Hidden Source of Inflation

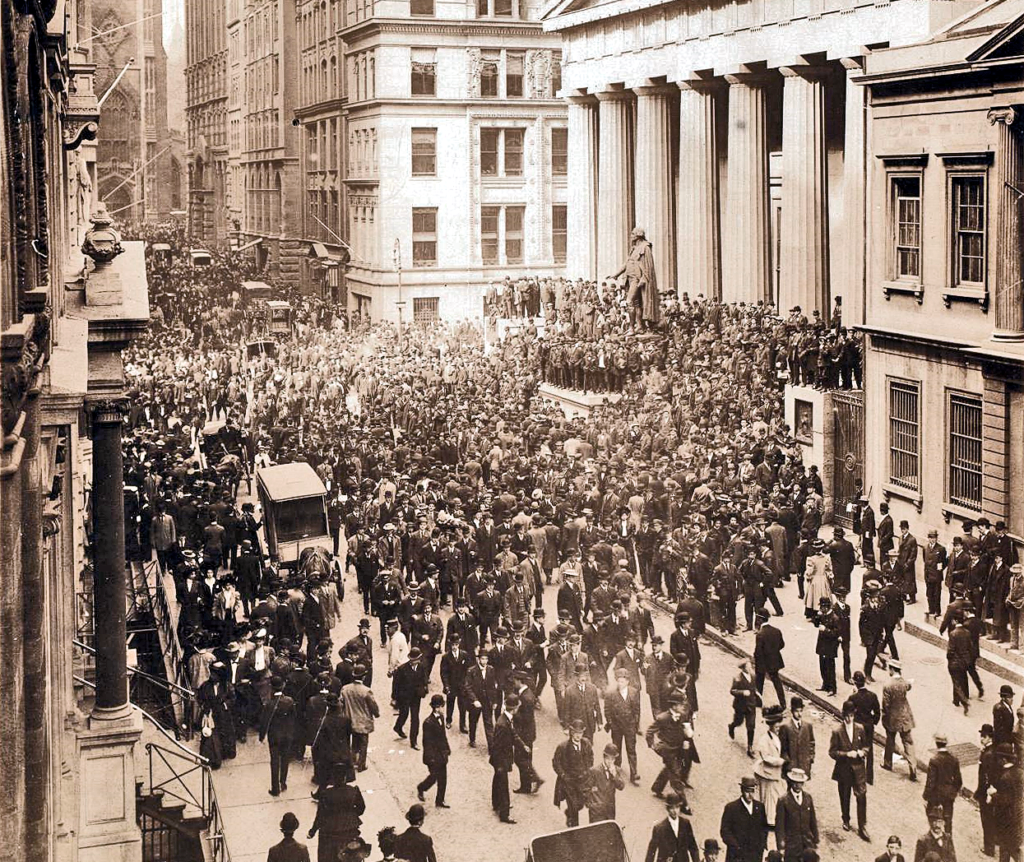

So, what is the hidden source of inflation? Perhaps a better word than “hidden” is unknown, for this “hidden source” is hiding in plain sight. There is quite a bit of history behind all this, but as I announced at the start of this paper, we’re keeping it simple. The broad strokes of it are that back in 1907 a major financial panic occurred, starting in New York, with an attendant stock market crash and public “bank runs” resulting in business and bank failures and much hardship for working people. Because of the Panic a hue and cry developed for banking reform, the ultimate result of which was the Federal Reserve Act, which was signed into law by President Woodrow Wilson on December 23, 1913, right before Congress recessed for the holidays. The machinations of top financiers during this period, people like JP Morgan [9] and John D. Rockefeller,[10] and their political henchmen, such as New York senator Nelson Aldrich,[11] have had conspiracy theorists drooling for decades, in my opinion not without reason. But that’s another story for another time. What the Federal Reserve Act did was authorize the creation of a new central bank for the United States, and it is since the Fed’s creation that inflation has had its way with our nation.

Why is this? I’m going to explain in the simplest terms, but before I do, you should understand several things about the Federal Reserve. First, though it was created by an act of Congress, charged with the responsibility of managing and stabilizing the U.S. monetary system, the Federal Reserve is a private bank with its stock owned by the private banking corporations comprising the country’s banking system. So, despite it having “Federal” in its name, it really is not. The Fed has a board of governors which the U.S. president has the power to appoint whenever a term expires, but the appointee is uniformly from the private banking sector. Also, despite being privately owned by the banks, the Fed is not a “private company” as the term is normally understood, and its stock is not publicly traded. In my opinion, the best way to view the Fed and the banking system in orbit around it, is as a “cartel” that manages the money supply, bank reserve requirements and interest rates for the national monetary system, much like OPEC controls oil supply and prices. The definition of the word “cartel” is, “an association of manufacturers or suppliers with the purpose of maintaining prices at a high level and restricting competition.“ [12] That is a good description of what the Federal Reserve system does relative to the U.S. banking and money system. It establishes the prevailing interest rates to be used in the banking system, as well as the reserve requirements the banks are required to maintain.

To answer the question of exactly how the Federal Reserve banking system causes inflation one must understand its role in the creation of our money, which consists of the following 7 steps:[13]

1. You may have noticed in recent years that from time to time our government runs out of money. During such moments there is much hand wringing in Congress about the need to get government spending under control, with the Democrats and Republicans tending to blame each other. Eventually, however, with key programs having their funding threatened, Congress falls in line and passes a bill to increase the national debt limit. Four our purposes here we will say that our legislators authorize a debt limit increase of $1 billion. The Treasury is then instructed to write an interest bearing bond for $1 billion.

2. The bond is offered to the Fed to buy, which it does by writing a check to the U.S. Treasury for $1 billion, which is then deposited in the government’s account. In doing this the Fed doesn’t have a spare $1 billion lying around to pay the government. Instead it creates the $1 billion and uses that credit to draw on to pay the government for the bond. In this action the Fed has created $1 billion from nothing.

3. The government then writes checks for its expenses, drawing on the $1 billion now in its checking account that was created from nothing by the Fed.

4. These government checks disburse throughout the nation, and the companies and people receiving them then deposit them in their own banks. The checks are then forwarded to the Fed by the banks, where the bank’s account is credited with the amount of the check, and the government’s account is debited with the amount of the check.

5. These credits to the banks from these cleared government checks then become “reserve deposit credits” for the banks.

So, what is a “reserve deposit credit”? [14]

You’ll recall that earlier in this article I stated that one of the functions of the Fed is establishing the reserve requirements for its member banks. At this point there is another finance and banking term to clear up, and that is “fractional reserve banking.” The goldsmith cited earlier, who started creating and distributing additional gold receipts without taking in more gold on deposit, was practicing “fractional reserve” banking, meaning simply that he had only a fraction in reserve of the amount of gold his distributed receipts indicated he should have. This practice has extended down through history and today is formalized in modern banks. When the Fed sets “reserve requirements” for the banks, it is dictating that the bank must keep in reserve a certain percentage, in the form of cash and credits, relative to the amount of money that bank is authorized to create in loans. This Fed mandated “reserve” is held in an account for the member bank at the closest branch of the Fed to the bank’s location. Again, the reserve consists only of cash, as well as credits derived from cleared checks deposited at the bank, but you should understand that only two specific kinds of check, when cleared, add to a bank’s reserve at the Fed. These two types are checks issued by the Fed itself for any expenses it may have, and checks issued by the U.S. Government (which are often based on Fed issued checks in exchange for government bonds).

In the interest of simplicity, if you are having trouble with the above it helps to demonstrate it using blocks, paperclips etc., or to diagram it out. The basic elements are these:

*The U.S. government is broke and needs more money, so it authorizes the Treasury to create interest bearing bonds and sells them to the Federal Reserve.

*The Fed buys the bonds by writing a check to the U.S. Government. The funds backing this check do not already exist, but are created by the Fed in the process of writing and issuing the check. (This sleight of hand is often missed by people, as it seems counterintuitive that such a thing can be done.)

*The Fed’s check to the government is deposited in the government’s account and is then drawn on by the government writing checks to cover its expenses.

*These government checks (plus any Fed Reserve checks issued to cover its expenses) then get deposited in the bank accounts of the check recipients.

* These cleared government and Fed Reserve checks, plus any cash the bank has acquired, form that bank’s reserve, which is recorded in the Fed branch closest to the bank’s location.

Now, understanding the above, here comes the real kicker:

6. If the Fed has mandated a 15% reserve requirement, it means that a bank’s reserve acquired as above can be up to 15% of what that bank is authorized to make in loans. Thus, a bank with $1 million in reserve can loan out at interest $6.67 million. (the algebraic formula being 15% of X = $1 million and then solve for “X” by dividing $1 million by .15) Keep in mind that the bank is not loaning out its reserve, which must remain at the Fed. Where, then, does the $6.67 million come from? The answer is that the lending bank, like the Fed did originally, creates it from nothing. In making its loans the bank does NOT loan out the money of others it has on deposit; instead it creates new money in the form of checking account deposits and loans that out.

7. Thus you can see in the process above, a total of $7.67 million (the original $1 million the Fed created and loaned, plus the $6.67 million the bank created and loaned) has been created from nothing and loaned into existence at interest.

In the above example, we have just had $7.67 million pumped into the economy. Keeping in mind the definition of inflation at the outset of this paper, unless we see a commensurate rise in production (goods and services) in the economy, inflation will result.

Oh…One More Thing

OK, if you are already familiar with the above, perhaps you can recall how shocking it was to you when you originally discovered that the Fed and banking system operate this way. And if you are just grasping this for the first time, there should be some light bulbs going off for you about the true cause of inflation, and why it has been happening since the Fed was established in 1913.

But, there is one more aspect to this that compounds the problem. Keep in mind that when the Fed and the banks make these loans that they are creating them from nothing and loaning the money out at interest. You can see, then, that ONLY the principle of the loan is being created, while the amount that must be paid in interest is NOT being created. The interest payments on the loans, whether paid by the U.S. government or by private borrowers, pulls money from the total money supply of the nation, reducing it thereby. This amount of interest being paid is not insignificant; for the U.S. government alone amounting to $663 billion in 2023; a figure equaling about 11% of the federal budget. Thus, one can see that due to the uncreated interest cost that must be paid there will never be enough money in the economy to pay off the loans, which excites the need for more loans and more money entering the system, creating a vicious cycle of more and more debt, more and more inflation, and more and more interest being paid for money created from nothing.[15]

Perhaps now you have a better understanding of what inflation is and how it is caused in our nation. Perhaps as well, you now understand exactly why the national debt graph and the CPI graph parallel each other and have since the Federal Reserve was created in 1913.

And, if you thought that the answer to all this might be doing away with the Federal Reserve system and the way it operates, well, you just might be on to something.

Stay tuned for Part II of this series.

[1] Definition from Hubbard Communications Office Policy Letter “Money” by L. Ron Hubbard

[2] Reference: The Oxford Dictionary

[3] Reference: the article “Economics” by L. Ron Hubbard, written on 17 March, 1966.

[4] Definition taken from Hubbard Communications Office Policy Letter “And That Is Banking” by L. Ron Hubbard

[5] Reference: Oxford Dictionary

[6] Definition taken from Hubbard Communications Office Policy Letter “Money” by L. Ron Hubbard

[7] Reference: Encarta Dictionary

[8] A Cartesian coordinate system is a method of describing a point’s location in space using perpendicular axes (like an x-axis and y-axis) where the position of a point is defined by its distance from the origin along each axis, essentially allowing you to pinpoint a location with numbers on a graph; named after René Descartes who developed the concept.

[9] John Pierpont (J.P.) Morgan (April 17, 1837 – March 31, 1913) was an American financier and investment banker who dominated corporate finance on Wall Street throughout the Gilded Age and Progressive Era. As the head of the banking firm that ultimately became known as J.P. Morgan and Company, he was a driving force behind the wave of industrial consolidations in the United States at the turn of the twentieth century. Over the course of his career on Wall Street, Morgan spearheaded the formation of several prominent multinational corporations including U.S. Steel, International Harvester, and General Electric. He and his partners also held controlling interests in numerous other American businesses including Aetna, Western Union, the Pullman Car Company, and 21 railroads.

[10] John Davison Rockefeller Sr. (July 8, 1839 – May 23, 1937) was an American industrialist, one of the wealthiest Americans of all time, and one of the richest people in modern history. Rockefeller was born into a large family in Upstate New York who moved several times before eventually settling in Cleveland, Ohio. He became an assistant bookkeeper at age 16 and went into several business partnerships beginning at age 20, concentrating his business on oil refining. Rockefeller founded the Standard Oil Company in 1870. He ran it until 1897 and remained its largest shareholder. In his retirement, he focused his energy and wealth on philanthropy, especially regarding education, medicine, higher education, and modernizing the Southern United States. Rockefeller’s wealth soared as kerosene and gasoline grew in importance, and he became the richest person in the country, controlling 90% of all oil in the United States at his peak in 1900.

[11] Nelson Wilmarth Aldrich (1841-1915) was a prominent American politician and a leader of the Republican Party in the United States Senate, where he represented Rhode Island from 1881 to 1911. One of the most powerful men in Washington, according to G. Edward Griffin in his book, “The Creature from Jekyll Island”, “Aldrich was considered to be the political spokesman for big business. As an investment associate of J.P. Morgan he had extensive holdings in banking, manufacturing and public utilities. His son-in-law was John D. Rockefeller Jr. Sixty years later, his grandson, Nelson Aldrich Rockefeller, would become Vice President of the United States.”

[12] In the late 19th century, from German “Kartell”, from French cartel, from Italian cartello, diminutive of carta, from Latin carta. It was originally used to refer to the coalition of the Conservatives and National Liberal parties in Germany (1887), and hence any political combination; later to denote a trade agreement (early 20th century).

[13] The reference used for this information is “The Truth in Money Book” by Theodore R. Thoren and Richard F. Warner, published in 1980.

[14] The source for this information is “The Truth in Money Book,” written in 1980 by Theodore R. Thoren and Richard F. Warner

[15] Source: “The Truth in Money Book” by Theodore R. Thoren and Richard F. Warner and U.S. Government pie charts of Federal budget.

8 Responses

good one Mark! Looking forward to part 2!

Thanks, Joe! Part II will be coming soon! Trust all is well. L M

Very well done Mark, The truth will set us free.

Thanks, Roger! To quote you, “The truth is a lonely hunter.” L M

Thanks Mark, I await the next. Joline

Thanks, Joline! I’ll have the next in a couple of weeks. L Mark

Hi Mark,

Chris Poulsen here. Been on a personal question to fully understand this same thing since about 2005. You have crystallized a LOT of research into a concise and understandable form. When you actually read the documents published by the Fed about how the system works. Unless you are nimble with word clearing, demos/sketches, you will fail to understand it as it is deliberately written to confuse.

Anyway, wanted to thank you for writing this. And to anyone who wants further information about this, please watch “The Money Masters – The Rise of the Bankers” by Bill Still (1996)

Link: https://www.youtube.com/watch?v=mDlnM481Gcg

Hey Chris! Great to hear from you, and thanks for the acknowledgement, as well as the link to the video. I’ll definitely watch it. I was just watching some politicians and pundits talk about the need to handle the national debt and the threat it represents. Not once did they mention the Federal Reserve. Astounding! L Mark